StashAway Doubles Down On Offering Environmental And Responsible Investing Options

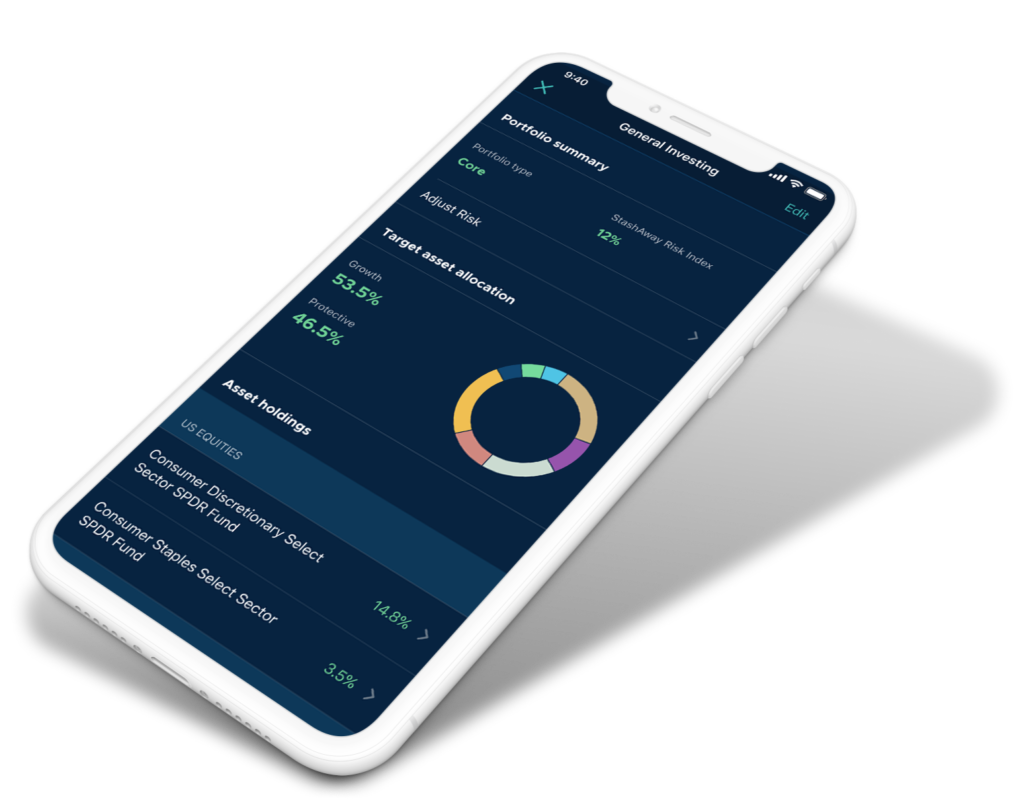

StashAway has expanded its investment offering by introducing two new portfolios that allow users to invest for good while also generating long-term returns: the Environment and Cleantech Thematic Portfolio and the Responsible Investing Portfolio. The latter is an ESG adaptation of StashAway’s classic General Portfolio. The two portfolios are optimised for both performance and impact.

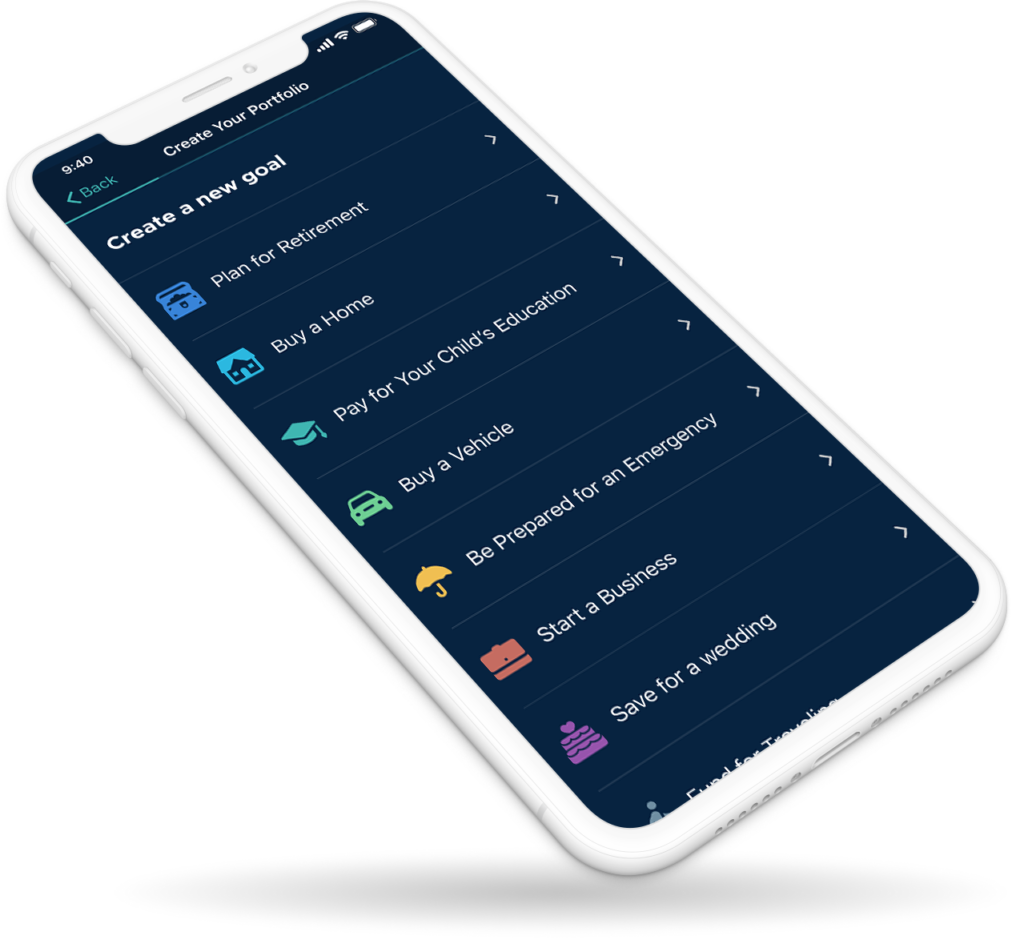

StashAway’s Responsible Investing Portfolio focuses exposure to for-profit companies deemed to have high ESG (Environmental, Social, and Governance) scores, which indicate positive social impact relating to sustainability, diversity, representation, corporate governance, and community. The Responsible Investing portfolio provides an option to build core wealth with ESG-focused principles, making it ideal for long-term financial goals, such as saving for retirement.

The Environment and Cleantech Thematic Portfolio allows users to diversify their investments to game- changing innovations in the sustainable solutions and low-carbon technologies space aimed at mitigating the impact of climate change. Specifically, it comprises a variety of sectors such as clean energy, clean water, energy storage, smart grids, green financing and waste management.

Ramzi Khleif, General Manager of StashAway MENA comments, “The momentum in ESG investing is increasing with every year and has now emerged as the largest sustainable investment strategy according to the 2020 Global Sustainable Investment Alliance report. The environment forms an integral part of each of our country’s history and heritage, and with the launch of these portfolios we are giving our investors the opportunity to invest in securing both their financial and environmental future.”

Freddy Lim, StashAway Co-founder and Chief Investment Officer, shares: “Investors have become more conscious about what industries and companies their money goes into: global momentum for ESG investing has been immense, with assets estimated to reach a third of global AUM by 2025, according to Bloomberg. We’re introducing these two portfolios because we want clients to have the option to invest in a way that allows them to positively shape the future of our planet and society while also generating long-term returns.”

Both portfolios are highly diversified and are made up of ETFs from some of the world’s top fund managers such as iShares (managed by BlackRock), Amundi, ARK Invest, Global X, and VanEck. The new portfolios have been made available to the company’s clients in Singapore, Malaysia, and the Middle East, with Hong Kong and Thailand to follow soon.